First companies producing individual unique products known as jobs use job costing also called job order costing. Boeing company is another of the publicly traded manufacturing companies and it is one of the leading manufactures of the aircraft.

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Hospitals law firms movie studios accounting firms advertising agencies and repair shops all use a variety of job order costing system to accumulate costs for accounting and billing purposes.

. Industries that produce unique or custom orders for individual customers including retail companies and hospitals typically use job order costing. Process costing is used by companies that make paint gasoline steel rubber and. Companies that mass produce a product allocate the costs to each department and use process costing.

The chart below shows how various companies choose different accounting systems depending on their products. Since Acme expects to spend 2500 on materials 3000. Industries that produce large amounts of a single product or similar products such as manufacturers of a single product typically use process costing.

For example Boeing uses job order. If a business or company produces different and unique products for customers then the business might need a job order costing system to properly manage each product and order. Costing System Analysis Nike uses a hybrid costing system since it incorporates both process and job order costing.

Regardless of the costing method used job order costing process costing or another method manufacturing companies are generally similar in their organizational structure and have a similar flow of goods through production. Job order costing is a system of assigning the cost of production to a specific manufacturing job and is mainly used by organizations providing customer-specific jobs. Law firms and accounting businesses.

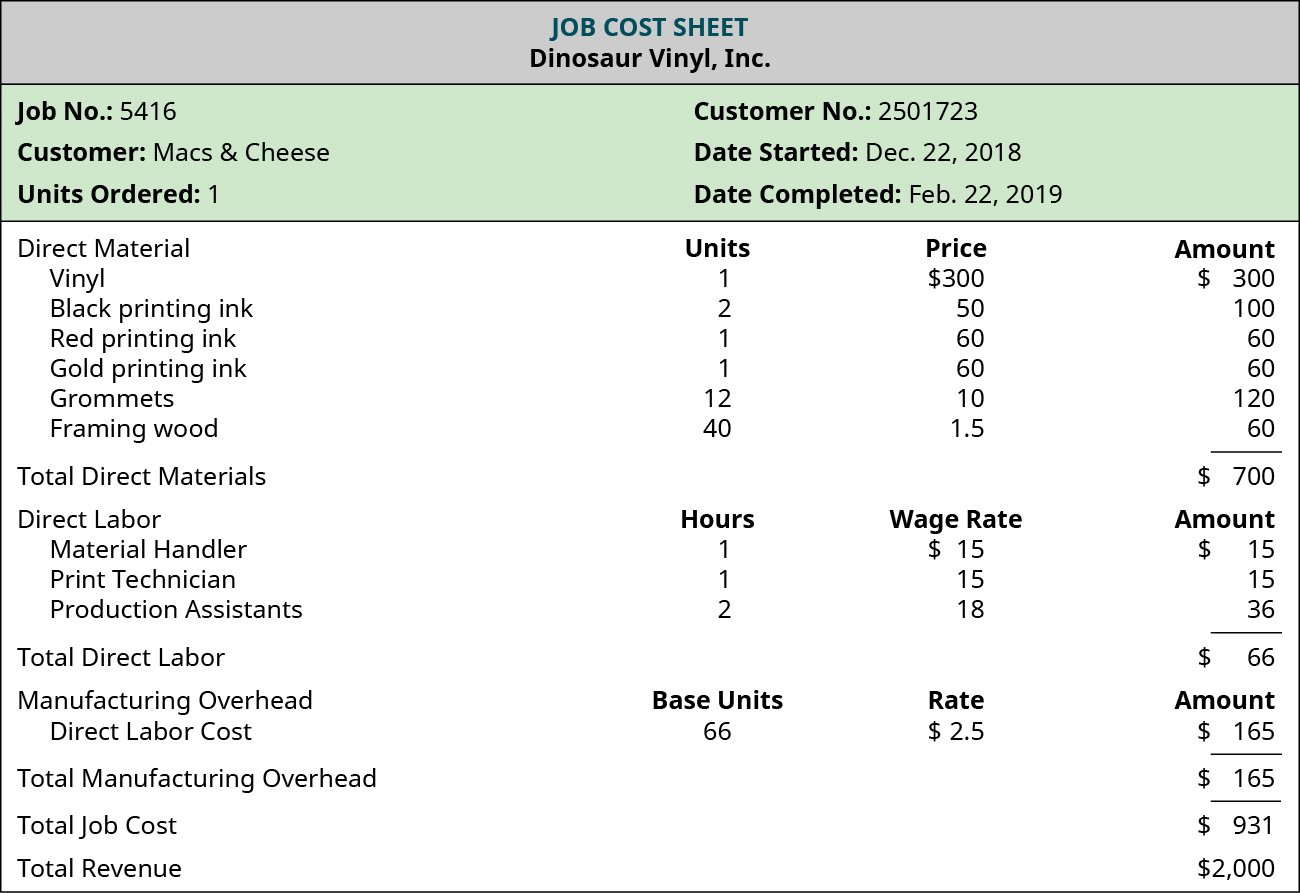

Medical services businesses including hospitals small doctors offices and medical billing companies can use job-order costing to consider each patient or bill as an individual job. The company just received the order from the customer on a custom job with estimated cost as below. The diagram in Figure 42 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl.

In job costing the cost is calculated after the completion of the job. The CEO has several direct reporting unitsFinancing. Definition Example And Objective.

This type of costing system would be. Apple uses the process costing method since it does mass production of similar products which include iPhones and the costs of these products are accounted for by the production process. 43 Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts.

42 Describe and Identify the Three Major Components of Product Costs under Job Order Costing. Industries that produce unique or custom orders for individual customers including retail companies and hospitals typically use job order costing. Company A uses job-order costing to calculate each product cost.

The critical differences between are as follows. Job order systems are custom orders because the cost of the direct material and direct labor are traced directly to the job being produced. Industries that produce large amounts of a single product or similar products such as manufacturers of a single product typically use process costing.

Record-keeping for job order costing in service industries including the medical field can be more complex than in other industries because these businesses offer a wide. Unique furniture fashion industry etc. In job order costing the company tracks the direct materials the direct labor and the manufacturing overhead costs to determine the cost of goods manufactured COGM Cost of Goods Manufactured COGM Cost of Goods Manufactured COGM is a term used in managerial.

A process cost system process costing collects costs associated with the production of a product based on the processes or departments that the product passes through on its way to completion. Regardless of the costing method used job order costing process costing or another method manufacturing companies are generally similar in their organizational structure and have a similar flow of goods through production. Job costing is used in cases where products produced are unique and process costing is used for the standardized products produced.

Job Order Costing System Definition. Job costing is more likely to be used for billings to customers since it details the exact costs consumed by projects commissioned by customers. And service-based industries eg.

For example General Mills uses process costing for its cereal pasta baking products and pet foods. Because in these businesses an individual customer usually represents a single job and each job needs to be. The CEO has several direct reporting unitsFinancing.

With job order costing products are made individually or in a smaller group rather. Companies such as construction companies and consulting firms produce jobs and use job costing. The diagram in Figure 81 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl.

Also this system is used when each output is different from others. However job order costing also plays a major role in the corporation because customers have the choice to personalize specific products. It means others cannot use the same product.

However in process costing the cost of each job is determined. Material 5000 units with cost 2 per unit. Job order costing is a costing method that is used for determining the production cost of each product.

41 Distinguish between Job Order Costing and Process Costing. Job order costing is suitable for industries where orders need to be completed for individual customers ie. Direct Labor 2000 hour with a cost of 10 per hour.

Hospitals firms law tax audit counseling etc investment companies etc. In situations where a company has a mixed production system that produces in large quantities but then customizes the finished product prior to shipment it is possible to use elements of both the. 44 Compute a Predetermined Overhead Rate and Apply Overhead to Production.

For example Coca-Cola may use process costing to track its costs to produce its beverages. With all four elements of the job order estimated its easy to create a job order costing estimate simply add the four costs together. A job-order costing system works best for products that are unique and produced one at a time or for service businesses such as lawyers or accountants.

Below are examples of different types of companies using job order costing systems to track inventory and how the process differs.

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

Job Costing Accounting System Double Entry Bookkeeping Cost Accounting Accounting Accounting Student

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing System I Think It Helps Us To Easier Un

Describes Job Order Costing Accounting Basics Managerial Accounting Information And Communications Technology

0 Comments